Thomas Barwick

The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers. - Warren Buffett

In general, we do not like the travel industry, particularly the airlines (JETS), which Warren Buffett has even warned can be bad for your investment health. More generally, we are also not big fans of the travel sector as a whole. Travel tends to be highly discretionary, and something people are quick to cut during difficult economic periods.

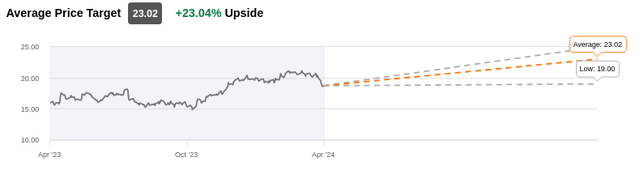

In the case of lodging REITs, they don't have long leases to get them through recessions, and prices can change from one day to the next. During past recessions average revenue per available room has declined significantly, and for prolonged periods of time, sometimes up to two or three years. Similar issues affect other companies in the sector, which makes it highly cyclical and has not delivered attractive returns for investors. A good proxy is the Amplify Travel Tech ETF (AWAY) launched a few years ago, and which has severely underperformed the S&P 500 Index (SPY).

Today, we want to focus on what we consider one of the best lodging operators, Host Hotels & Resorts (NASDAQ:HST). We think it is one of the most deserving lodging REITs, and we want to start following in case an attractive buying opportunity presents itself.

We are very skeptical of the whole sector, as we see many issues. These include the sensitivity to economic conditions, several intermediaries taking a cut of the revenues, including online travel agencies and digital marketing platforms such as Tripadvisor (TRIP), Booking Holdings (BKNG), and Alphabet (GOOGL) (GOOG). These REITs usually have to pay royalties to brand owners such as Marriott International (MAR), Hyatt Hotels (H), and Hilton Worldwide (HLT). If that was not enough, things have only gotten more competitive with the rise of Airbnb (ABNB) and Booking and their alternative accommodation offerings.

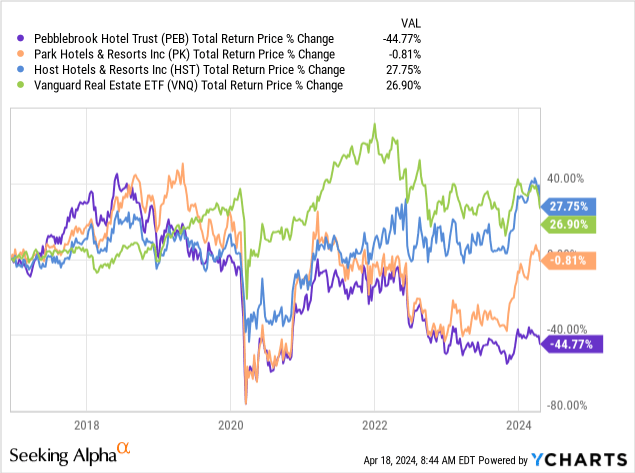

Still, the company appears well managed and has actually outperformed the popular Vanguard Real Estate ETF (VNQ) the last few years on a total return basis. Its performance is significantly better compared to peers such as Pebblebrook Hotel Trust (PEB) and Park Hotels & Resorts (PK).

Company Overview

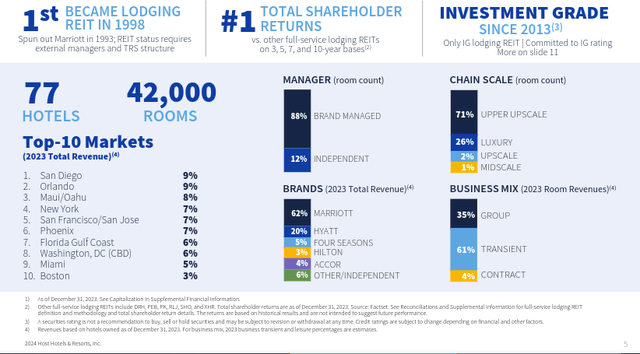

Host Hotels has 77 hotels and is focused on upper upscale and luxury assets, which we think is a good strategy as customers tend to be less price-sensitive in these categories, and more focused on the quality of the rooms and services. The company claims it has delivered the best total shareholder returns compared to peers on a 3, 5, 7, and 10-year basis, and is part of the S&P index. The company is mostly focused on the U.S. market but has good diversification among different cities.

Host Hotels & Resorts Investor Presentation

Headwinds & Tailwinds

The company has been benefiting from a rebound in travel after the Covid pandemic ended, and the industry has, in general, been able to pass price increases to customers, but occupancy remains below pre-Covid levels. Another potential tailwind is that regulations are forcing alternative accommodation providers to compete on a more leveled playing field, including those regarding taxes and fees.

While tourism has basically recovered, business travel remains subdued, and we believe this might prove a permanent change. We believe it is a similar effect to what has happened to office attendance, with employees getting increasingly comfortable with virtual meetings and online collaboration tools. Another important headwind for these REITs is the higher interest rate environment, given that in most cases, new debt is now more expensive compared to the one that is maturing.

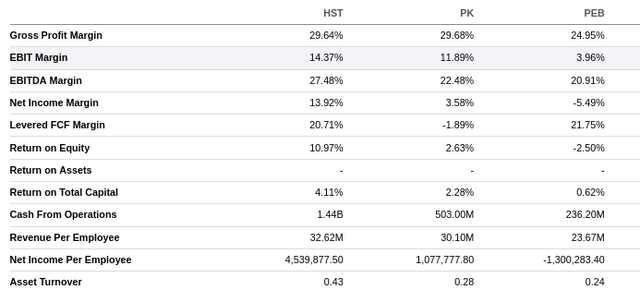

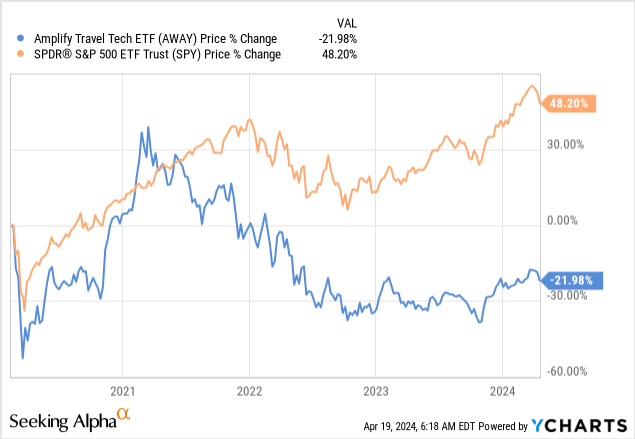

Peer Comparison

Host Hotels has much healthier profit margins and returns on equity compared to most peers, as can be seen in the table below. Its return on equity at ~11% is not bad, and its EBITDA margin is several points higher compared to the competition.

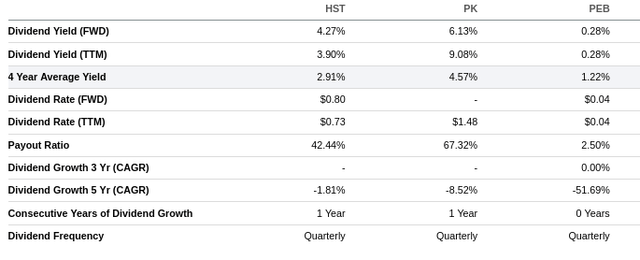

Even though Park Hotels & Resorts has a higher dividend yield than Pebblebrook, we would argue Host Hotels & Resorts remains the better option, as its payout is significantly lower.

Investors should also take into consideration that Host Hotels & Resorts has returned significant amounts of capital to shareholders through share repurchases. Since 2022 the company has bought back more than 13 million shares at an average price of ~$15.9, and it has almost $800 million remaining capacity under its current repurchase program.

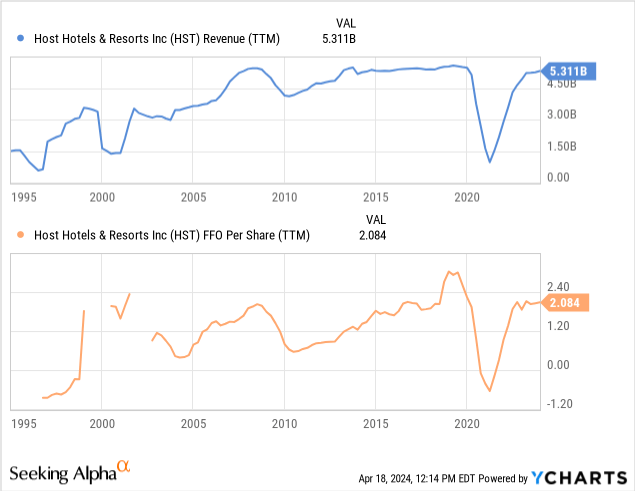

Growth

The combination of higher prices with lower occupancy, compared to the pre-Covid era, has resulted in a similar level to what the company was generating before that external shock. Still, as can be seen in the revenue graph, even before the pandemic the company was already struggling to grow revenue. Funds from operations per share have significantly recovered but are still below its all-time high reached before the pandemic.

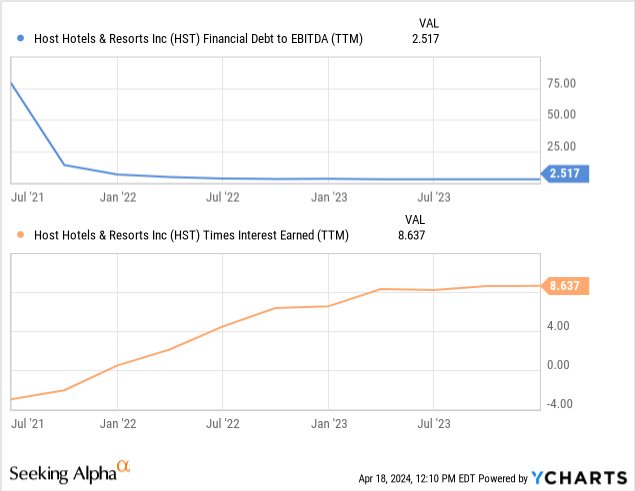

Balance Sheet

Host is now in much better shape after the dramatic shock it suffered during the Covid pandemic. Its metrics are once again at healthy levels, for example, its financial debt to EBITDA is below 3x, and its interest coverage is above 8x.

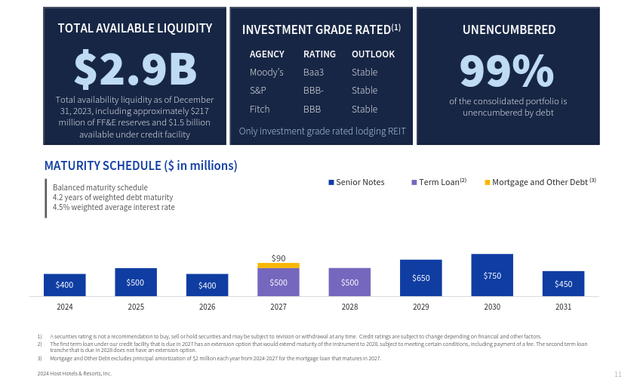

The company has significant liquidity and a well-staggered debt maturity schedule, carrying what is now a very low weighted average interest rate of ~4.5%.

This has resulted in investment credit rating from the major agencies, including a 'Baa3' grade from Moody's (MCO) and 'BBB-' from S&P Global (SPGI), both with stable outlook. The company claims it is the only lodging REIT that has an investment grade credit rating.

Host Hotels & Resorts Investor Presentation

Marriott and Hilton

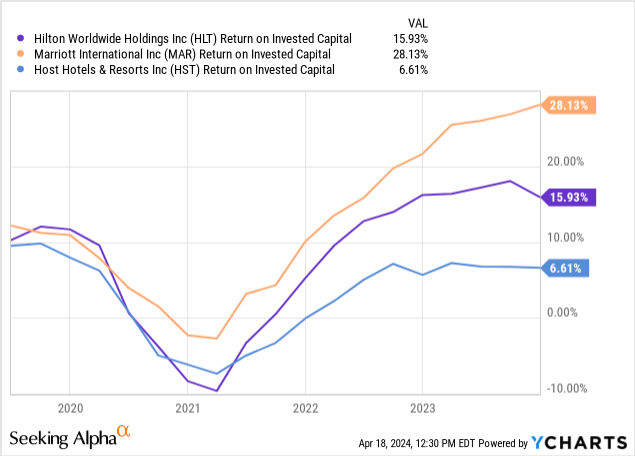

While we believe Host Hotels & Resorts is probably the best lodging REIT available in the U.S. markets, we do not think it is the best investment in the travel sector. Companies like Marriott and Hilton, with their asset-light capital strategy and competitive moats from the strength of their brands, display superior financials. Still, they are certainly a very different option, with much smaller dividends, so we do not consider them to be peer companies.

Sustainability

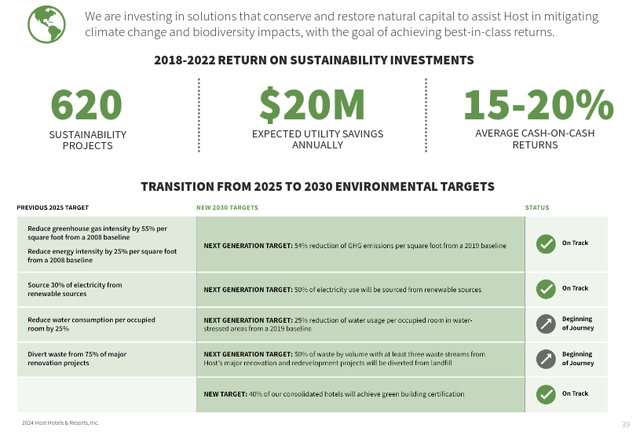

One area where Host Hotels & Resorts has gained significant praise is with its sustainability efforts. Publications like Barron's and Newsweek have put it on their lists of most sustainable companies. Global environmental non-profit CDP gives a very high 'A-' grade to the company regarding its efforts to combat climate change, while its competitors did not even respond, and were therefore assigned an 'F' grade.

| REIT | Area | Grade |

| Host Hotels | Climate Change 2023 | A- |

| Park Hotels | Climate Change 2023 | F (No Response) |

| Pebblebrook Hotel | Climate Change 2023 | F (No Response) |

These efforts are not only good for the planet, but reducing waste and inefficiencies has been good for the bottom line as well. According to the company, its sustainability investments are generating between 15% and 20% returns, and it is saving around $20 million annually just from utility costs.

Host Hotels & Resorts Investor Presentation

Future Outlook

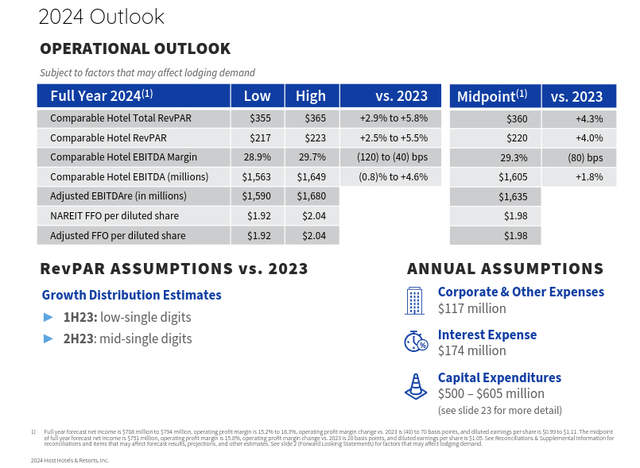

For 2024 the company is expecting higher revenue per available room, but with increasing costs, it expects margins to be pressured and slightly down compared to the previous year. At the mid-point, the company expects FFO per diluted share of $1.98.

Host Hotels & Resorts Investor Presentation

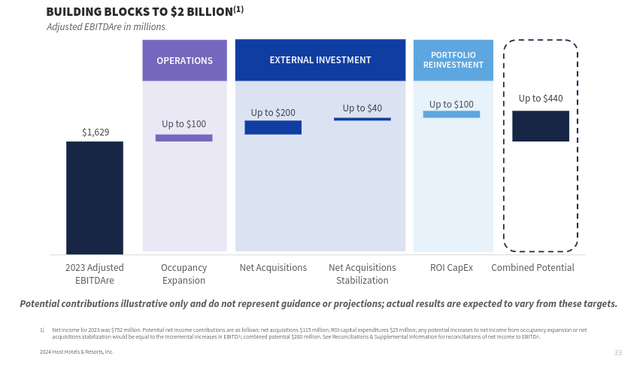

Looking further ahead, the company sees around $440M of potential incremental future stabilized EBITDA compared to the $1.6 billion it achieved in 2023. This would be accomplished through operational improvements, occupancy improvements, and new investments. It is worth noting that the company has a good history of accretive capital recycling, managing to buy properties at lower multiples compared to the multiples they have been selling assets at.

One key assumption the company is using for their $2 billion adjusted EBITDAre target is occupancy rising around 4% above 2023 levels, which would require regaining about half of the occupancy gap between 2023 and 2019. We believe EBITDAre gains from occupancy expansion will be the hardest to accomplish, especially if the economy weakens or the competitive environment intensifies with continued expansion from alternative accommodation providers.

Host Hotels & Resorts Investor Presentation

Valuation

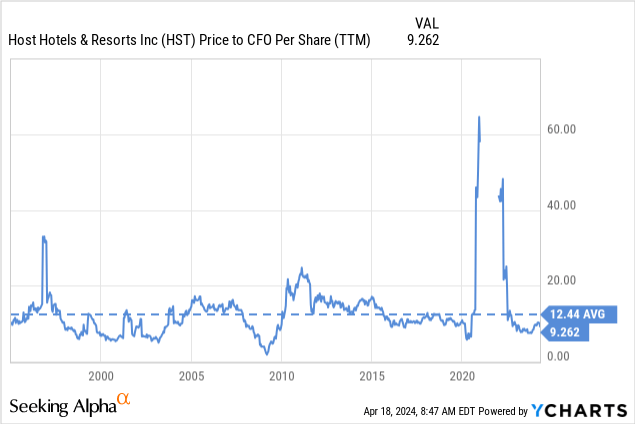

One thing shares have in their favor is an attractive valuation, with a price to cash-flow from operations per share of around 9x, they certainly do not look expensive. This multiple is about a quarter below the historical average for the company.

Based on our estimates for their future FFO per share we calculated a net present value of $26, which means the current valuation would be offering a significant margin of safety.

| FFO per share | Discounted @ 10% | |

| FY 24E | 1.98 | 1.80 |

| FY 25E | 2.06 | 1.70 |

| FY 26E | 2.23 | 1.68 |

| FY 27E | 2.30 | 1.57 |

| FY 28E | 2.37 | 1.47 |

| FY 29E | 2.44 | 1.38 |

| FY 30E | 2.51 | 1.29 |

| FY 31E | 2.59 | 1.21 |

| FY 32E | 2.66 | 1.13 |

| FY 33E | 2.74 | 1.06 |

| FY 34E | 2.82 | 0.99 |

| Terminal Value @ 2% terminal growth | 34.28 | 10.92 |

| NPV | $26.19 |

Analysts are on average slightly less optimistic but still see shares offering a ~23% potential gain to their average price target. Based on an average price target of $23 per share, the one-year potential gain would be about 23%.

Risks

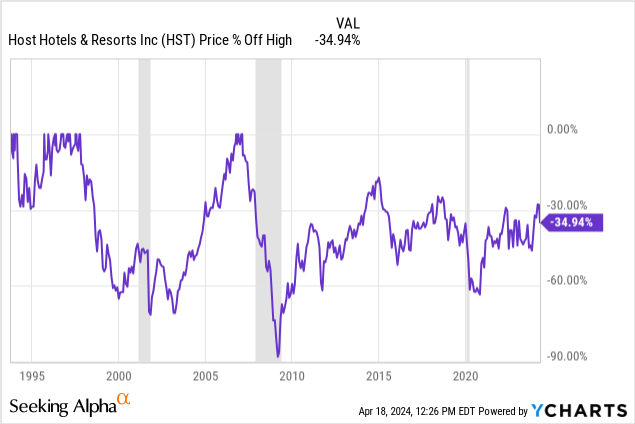

While we see shares as undervalued, we do believe risk is above average. As can be seen in the graph below, shares have experienced very significant drops when recessions have occurred. While economic indicators in the U.S. appear to be signaling that the risk of a severe recession is decreasing, there are still worrying trends such as increasing delinquencies in credit card loans.

There is also a longer-term risk that alternative accommodations such as those offered by Airbnb and Booking continue to take market share.

Conclusion

Host Hotels & Resorts is the lodging REIT we like best, and we see shares currently trading at an attractive valuation. Still, we see the travel industry as highly cyclical and generally unattractive. In addition to the low valuation, the company has outlined potential avenues to grow its EBITDAre, and its dividend appears well covered given the low payout ratio. The company has also returned significant capital to shareholders through share repurchases, which we believe are highly accretive at current low prices.