VIKTOR FEDORENKO/iStock via Getty Images

Synopsis

James Hardie Industries (NYSE:JHX) specializes in the production and sale of fiber cement and fiber gypsum building solutions. JHX's last three years financial results have shown consistent net sales growth. In addition, it was able to maintain its margins throughout the same period by focusing on selling higher-margin products and practicing lean manufacturing processes. For its latest 3Q24 earnings results, net sales were up 14% year-over-year, driven by growth in all of its sales segments. Looking ahead, single-family starts are expected to increase. However, the weakness of the multi-family starts will offset some of the strength of the single-family starts. In my relative valuation model, my target price is close to its last traded share price. Therefore, I believe JHX lacks sufficient margin of safety given the mixed housing outlook. On this note, I am recommending a hold rating for JHX.

Historical Financial Analysis

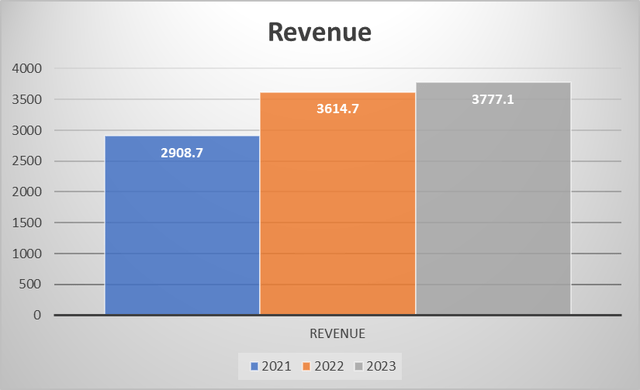

Over the last three years, JHX's net sales have been consistently growing. In FY2021, it reported net sales of ~$2.908 billion, and it grew to ~$3.614 billion in FY2022. This strong growth was primarily driven by increased pricing and a better product mix. In addition, volume increased 14% year-over-year, which also contributed to the top-line growth.

For FY2023, revenue continued to grow and reach ~$3.777 billion. However, revenue growth was modest at 4% as it was affected by the decline in volume of 5% in that year. The volume decline was caused by a weaker global housing market condition.

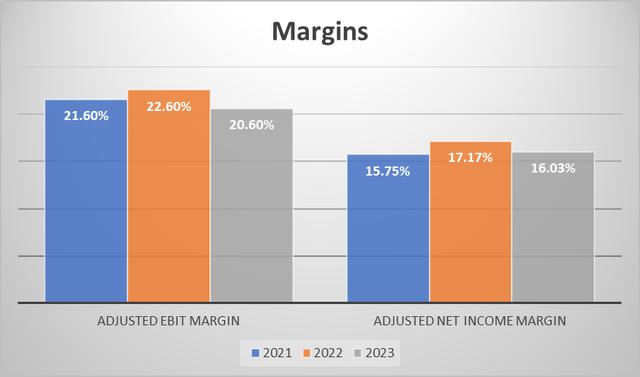

Moving down JHX's P&L, both its adjusted EBIT margin and adjusted net income margin over the last three years were robust and healthy, as there were no significant contractions or expansions. The reason for the robust adjusted EBIT margin and adjusted net income margin was attributed to its strategic initiatives and direction. In order to combat rising costs due to inflation, JHX focuses on high value product mix, as these products generate higher margins. Additionally, it also implemented lean manufacturing initiatives, which allowed JHX to absorb the rising costs caused by inflation.

Business Overview

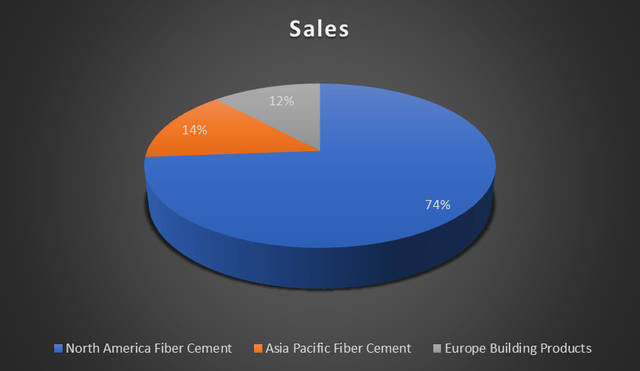

JHX is the leading manufacturer of fiber cement and fiber gypsum. Based on its 2023 annual report, its North America fiber cement, which accounts for 74%, makes up the largest share of its total revenue. Following closely behind with similar weightage are its Asia Pacific [APAC] fiber cement segment and European building products segments, with 14% and 12%, respectively. For the European building products segment, it consists of both fiber cement and fiber gypsum revenues, whereas North America and APAC only include fiber cement revenues.

As mentioned, JHX produces and sells fiber cement and fiber gypsum building products. These products are used for both interior and exterior building construction applications. Therefore, the demand for JHX's products is highly dependent on the construction market, mainly residential construction and, to a lesser extent, commercial construction.

3Q24 Earnings Analysis

For 3Q24, JHX's net sales were up 14% year-over-year to ~$978 million. For the previous period, net sales reported were ~$860 million. The double-digit growth in its top line was driven by strong growth in all three segments. Firstly, for the North America fiber cement segment, net sales grew 13% year-over-year, driven by growth in both the average net sales price of 3% and volume of 9%.

Onto its Asia Pacific fiber cement segment, net sales grew even higher at 21%. This growth was also driven by average net sales price growth of 14% and volume growth of 6%. Lastly, for its Europe Building Products segment, net sales grew by 8%. Growth was modest due to average net sales price growth being offset by volume weakness. For the quarter, volume was down 10%.

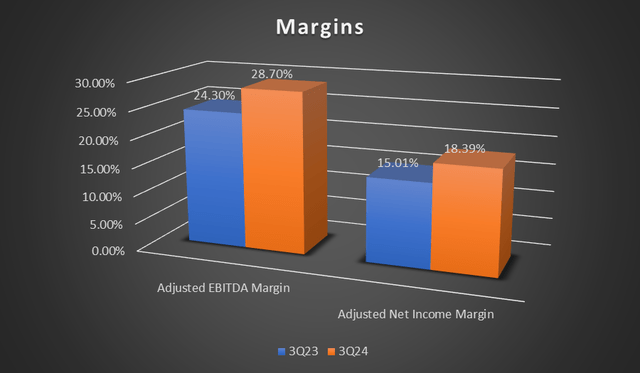

Moving onto its profitability margins, JHX performed well in 3Q24 as both adjusted EBITDA margin and adjusted net income margin expanded year-over-year. Adjusted EBITDA margin grew from 24.30% to 28.70%, while adjusted net income margin expanded from 15.01% to 18.39%. The growth in its consolidated adjusted margins was driven by strong margin expansion in all three segments.

For its North America fiber cement segment, EBIT margin expanded from the previous period's 27% to 32.7%, an improvement of ~5.7%. For its Asia Pacific fiber cement segment, EBIT margin growth was lesser but still respectable. It expanded from 24.7% to 27.5%. Lastly, its Europe Building Products segment reported an EBIT of 6.5% vs. the previous period's 1.5%. As a result of the strong adjusted EBITDA margin, it benefited its adjusted net income margin. For 3Q24, adjusted diluted EPS increased a staggering 41% to $0.41 per share.

Strong Single Family Starts Outlook

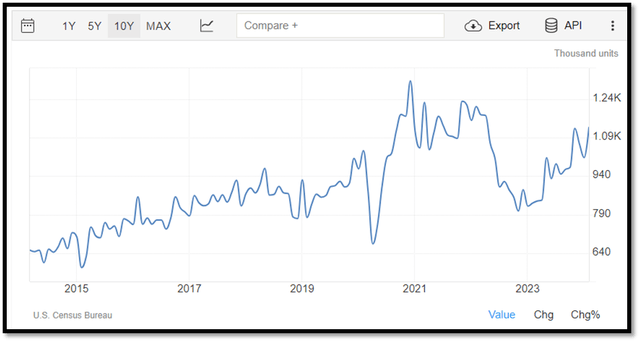

In 2022 and 2023, US single-family starts were severely affected by rising inflation, which drove interest rates up. For 2024, the National Association of Home Builders [NAHB] is expecting single-family housing starts to improve, as the Fed has already signaled its intention to cut rates in 2024. As interest rates decline, the NAHB forecasts single-family starts for 2024 to grow by ~4.7% to 988,000 units. For 2025, the NAHB continues to expect the single-family starts to grow. It is forecast to reach 1.03 million units.

Looking at the chart, it's clear that since the start of 2023, US single-family starts have started to recover, and it has been consistently increasing. In January 2023, single-family starts were ~823,000 units. As of February 2024, it had expanded to 1,130,000 units, showing a healthy upward trend. In the US, the housing shortage is estimated at ~1.5 million units. Therefore, the increasing housing supply forecast is expected to ease the affordability issue that is plaguing the US. If housing becomes affordable, it will drive up demand for more houses in the US.

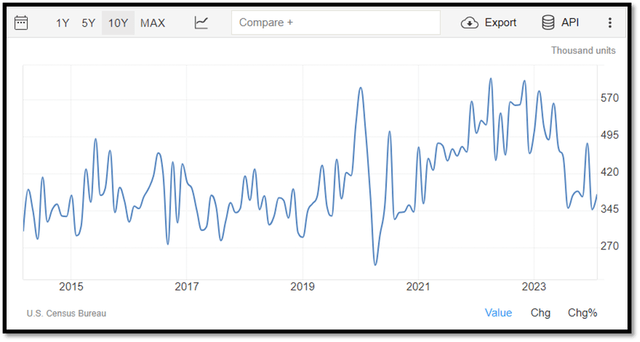

Multi Family Is Expected to Decline

Despite a positive outlook for single-family starts, multi-family starts are painting another story. For 2024, NAHB forecasts that multi-family starts will drop ~20% to 379,000 units. The reason behind the forecasted decline is due to the high number of units under construction. Currently, there are ~1 million units under construction, which is near the highest level ever recorded. In addition, the tight lending conditions and high development loan expenses are also creating pressure on multi-family starts.

Looking ahead, as these units are completed, the fresh injection of new unit supplies is expected to slow down rental expenses and bring inflation down. Therefore, for 2025, the NAHB expects the multi-family market to stabilize and forecasts that multi-family starts will reach ~388,000 units.

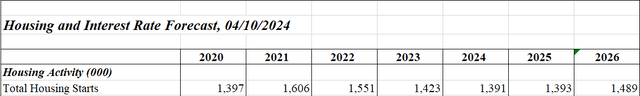

Looking ahead, the US housing market is expected to recover gradually. After hitting its peak of ~1.606 million in 2021, it started to decline in 2022 due to macroeconomic challenges. For 2024, it is expected to be ~1.391 million, while for 2025, it is expected to remain flat. For 2026, the housing market is expected to improve as total US housing starts are forecasted to reach ~1.489 million. Therefore, for the next few years, the positive outlook and anticipated recovery in the US housing market will bolster JHX's growth outlook.

National Association of Home Builders

Relative Valuation Model

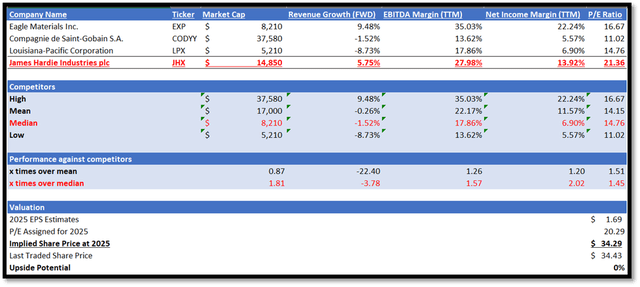

I will be comparing JHX against its peers in terms of forward growth outlook and profitability margins. In terms of forward growth outlook, JHX clearly outperformed its peers. JHX has a forward revenue growth rate of 5.75%, while its peers' median is negative 1.52%.

In terms of profit margins, JHX also outperformed its peers' in both EBITDA margin TTM and net income margin TTM. Firstly, JHX has an EBITDA margin TTM of 27.98%, while its peers' median is 17.86%. Next, JHX's net income margin TTM of 13.92% is also higher than its peers' median of 6.90%.

Currently, JHX's forward non-GAAP P/E ratio is trading at 21.36x, which is higher than its peers' median of 14.76x. Given JHX's better performance in terms of forward growth outlook and profit margins, it is reasonable for JHX to trade at a premium. However, JHX's P/E premium over its peers' median is a bit too high, in my opinion. Currently, the premium is ~44%. In order to remain conservative, I will be applying a small discount of about 5% to JHX's current P/E ratio, and this gives me 20.29x.

For 2024, the market estimate for JHX's revenue is ~$3.95 billion, while for 2025, it is ~$4.27 billion. In terms of EPS, the 2024 estimate is ~$1.60 per share, while 2025 is ~$1.69 per share. Given the housing outlook discussed, these estimates are reasonable as they share similar sentiments.

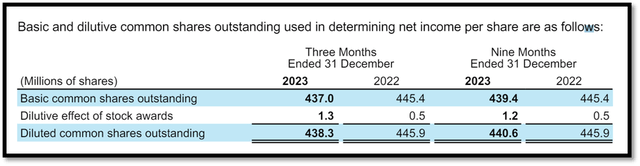

In addition, management guided 4Q24's adjusted net income to be between $165 to $185 million. If I use the midpoint of $175 million and add it to its 9M24 adjusted net income of $533.3 million, this gives me ~$708 million for the full year. Dividing this by its fully diluted shares outstanding, the estimated EPS is ~$1.60, which is in line with the market estimate. By applying my target P/E of 20.29x to JHX's 2025 EPS estimate, my 2025 target price is ~$34.29, which is in line with its last traded share price.

10-Q Author's Relative Valuation Model

Risk

As discussed, JHX's business relies on the strength of the residential and commercial construction markets. The strength of this market is dependent on a few factors, such as inflation, interest rates, and mortgage rates. If inflation were to cool more than expected, it might give the Fed the confidence it needs to start cutting rates in 2024. This would result in a lower interest rate and mortgage rate, which might serve as a catalyst for the residential and commercial construction markets. If activities were to start picking up, it would result in increased demand for JHX's products, which would benefit its net sales and operating income.

Conclusion

JHX's historical financial results have shown continued top-line net sales growth. However, in FY2023, net sales growth has slowed down to a single-digit percentage due to a weak global housing market condition. Despite this, its margins over the last three years have remained relatively robust. For 3Q24, net sales were up 14% year-over-year, driven by strong growth in all three sales segments. The growth was mostly attributed to a higher average net sales price and volume. Looking ahead a few years, the NAHB anticipates single-family starts to increase in both 2024 and 2025. However, multi-family starts are forecast to decline, offsetting the single-family positive outlook. Combining this with a lack of margin of safety in its share price, I am recommending a hold rating for JHX.