domin_domin

Introduction & Investment Thesis

2023 was one of the most climactic years in the history of technology as generative AI unveiled itself to the world, building upon decades of innovation in technology. The previous earnings season that closed its curtains on full-year 2023 earnings demonstrated two key themes that distinguished outperformers in the technology and software industry from the laggards, per my observation.

The first driver is AI, where the winners in the software industry demonstrated their commitment to investing in AI while trying to build capabilities in their solutions to drive their product roadmaps. Even better, if technology and software companies were able to demonstrate an incremental impact on their revenue growth from AI due to deployment and increased usage.

The second driver is the trend towards vendor consolidations, where businesses are moving away from multiple point solutions to a fully integrated platform in order to gain a better pricing advantage while streamlining their operating expenses. Once again, the companies in the software industry that continued to position themselves and benefit from this trend saw increased spend per customer with deepening adoption, allowing them to gain economies of scale and expand margins.

With markets having had an impressive run through the first three months, I believe that software stocks such as Microsoft (MSFT), ServiceNow (NOW), IBM (IBM), etc. are faced with meeting lofty expectations in the upcoming Q1 2024 earnings season, and AI and vendor consolidation will continue to differentiate winners from laggards.

Despite the high valuation multiples and macroeconomic uncertainties, I believe long-term trends remain intact for selected software stocks. Furthermore, should we see a valuation reset of the S&P 500 to its longer-term averages driven by market volatility, I believe it will provide long-term attractive entry points depending on how selected software companies continue to deepen adoption and grow spend on their platform as they build out their AI roadmaps while continuing to maintain or expand their operating margins.

The Journey So Far: Tech Leads Markets Buoyed By AI

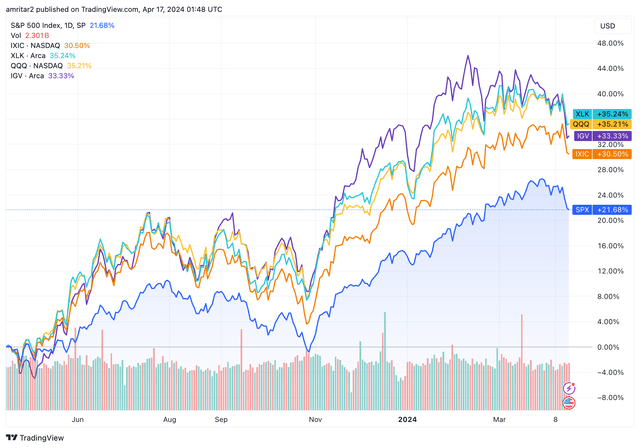

Before I delve into what my outlook is for Q1 earnings, I believe it is important to take a step back and get a bird's-eye view of the performance of software stocks over the Trailing Twelve Months (TTM) relative to the broader market indices. I have used some ETFs to aggregate the trends for different areas of software, as you can see below.

Performance of technology and software ETFs vs indices

As you can see, the technology-heavy Nasdaq 100 index (COMP:IND) outperformed the broader markets, as reflected by the S&P 500 Index (SPX). Meanwhile, software stocks represented by the iShares Expanded Tech-Software Sector ETF (BATS:IGV) and the Technology Select Sector SPDR® Fund ETF (XLK) had been riding in the front with the QQQ (QQQ) up until March 2024, when IGV got pulled down by subpar earnings performances from Salesforce (CRM), Adobe (ADBE), and Palo Alto Network (PANW), while QQQ is currently trailing behind XLK, as it is getting weighed down by demand dilution seen with Apple (AAPL) and Tesla’s (TSLA) products along with Apple’s legal headaches.

Two Key Insights Stand Out From Previous Earnings Reports of Software Companies

I’ll start this section by borrowing insight from one of my top picks in software, Microsoft. During the earnings call, Satya Nadella, CEO of Microsoft mentioned that the company is beginning to reap the rewards of working on plans to deploy AI in their products through last year, where they are winning new customers as they infuse AI across their tech stack, enabling businesses to drive productivity gains across every sector. He further highlighted the robustness of Microsoft’s Intelligent Cloud division, which houses Azure.

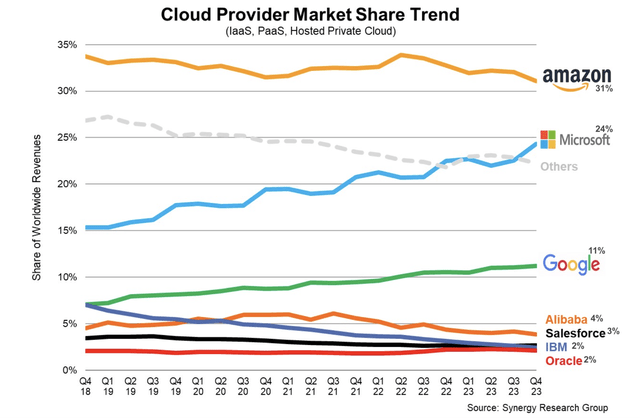

Furthermore, I found this market research study that was published in February that validates what Nadella has been saying, where Microsoft's Azure has been steadily gaining market share with their AI advantage.

Amazon’s AWS maintains cloud market share while Microsoft edges closer

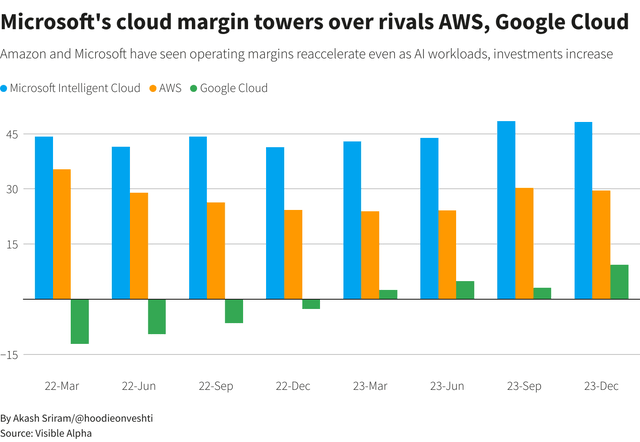

Although Amazon (AMZN) and Google (GOOG) both hold promising futures in the cloud infrastructure market, I believe that Microsoft is boldly leaping ahead, where it is not just gaining market share, but doing so while expanding their margins at the same time, as per this analysis, which I am attaching below.

Microsoft’s cloud margins towers over rivals, Amazon’s AWS and Google Cloud

The second insight that I would like to draw your attention to is that 2023 was also the year of Vendor Consolidation in the software application complex. In the previous quarter, ServiceNow reported exceptional progress in their deal velocity, closing 168 deals with a net new Annual Contract Value (ACV) greater than $1M, growing a whopping 33% YoY. The robust performance gave them the confidence to raise their FY24’s revenue guidance to $10.6B, up from the $10.4B target issued in the FY23 Investor Day Presentation.

During the earnings call, the company also talked about the vendor/platform consolidation trends it was benefiting from. In the TMT Conference last month, ServiceNow reiterated that platform consolidation along with a consistent roadmap of robust AI capabilities would continue to propel the company forward as it drives new customer acquisition while deepening adoption of its solution suite among existing customers.

Another favorite pick of mine, Datadog (DDOG), also echoed the comments made by ServiceNow’s management on their earnings call. When asked about adding more color to the vendor consolidation trends Datadog was seeing in their market, Olivier Pomel, CEO of Datadog, said the following.

“So in general, what we do is when we do these larger multi product or consolidation deals, we have a specific rate card and customers can have total fund commitment and customers can allocate the funds in real time to the products they need, which, by the way, gives them a lot of flexibility they don't have when to manage like five different vendors for different parts of their coverage.”

In my opinion, software companies that have successfully invested in AI and are now building it into their product roadmaps to drive revenue growth while protecting their operating margins have seen their stocks outperform. I believe that is the case because businesses are increasingly consolidating from multiple vendors into a fully integrated platform in order to gain a price advantage, while they adopt AI products to improve their productivity gains and reduce overhead. This has allowed the winning software companies to drive deeper adoption of this solution suite, with larger spend per customer, leading to higher economies of scale and profit margins.

Changes in outlook in the software industry year to date

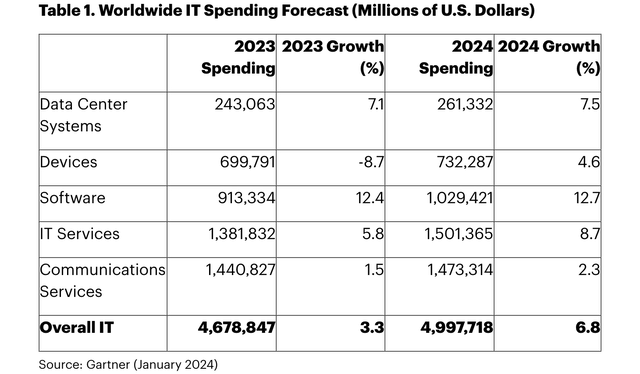

There are forecasts from multiple research sources that suggest that the tailwinds are still intact for software stocks to continue their outperformance over the long-term, despite the recent pullback that we are observing in the broader indices.

The last update from Gartner projects that the overall IT spend will grow by 6.8% in 2024, more than double the growth rate seen in 2023. In fact, the bulk of the growth in spending is expected to come from Software, which is projected to grow 12.7% YoY, while spending in IT Services is expected to grow 8.7% YoY.

Gartner projects IT Spend will grow 6.8% in 2024

However, with expectations of GenAI being elevated, Gartner also gently cautions against being overly optimistic about AI’s impact on business growth in 2024. Their research suggests that IT spending will likely not be impacted in 2024, as companies will continue to invest in planning to integrate AI in their organizations and product roadmaps through this year while still projecting strong double-digit growth in AI over the next five years.

“While GenAI will change everything, it won’t impact IT spending significantly, similar to IoT, blockchain, and other big trends we have experienced,” said John-David Lovelock, Distinguished VP Analyst at Gartner. “2024 will be the year when organizations actually invest in planning for how to use GenAI, however IT spending will be driven by more traditional forces, such as profitability, labor, and dragged down by a continued wave of change fatigue.”

In my view, this will be a key point to watch for in Q1 earnings. I believe the elevated levels of optimism among investors suggest that markets are looking for companies to further illustrate the revenue impact from AI. This was evident in market action immediately after Microsoft reported its last earnings. On the other hand, Google has struggled to demonstrate any meaningful revenue bump from AI adoption in its services.

Q1 Outlook and Key Earnings to Watch

Based on consensus estimates from FactSet, the S&P 500 is expected to grow its earnings in Q1 by 7% on a YoY basis. Meanwhile, the IT sector is expected to report a 7.6% YoY growth rate in its earnings, excluding Nvidia (NVDA), while the software complex of stocks is projected to grow its earnings by 15% YoY in Q1 2024.

On the revenue front, while the S&P 500 is expected to grow its revenues by 3.5% YoY in Q1, the software sector is expected to grow its revenue by a considerably higher 13% YoY.

I have added a list of stocks below that I believe are well-positioned to continue riding the wave. Here is a list:

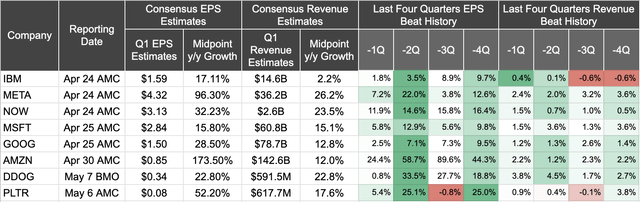

Key Earnings and Expectations. Only Microsoft follows a different calendar cadence reporting Q3 FY24 numbers

As you can see above, most of these companies are expected to grow their earnings much faster than the general projection of a 15% YoY growth rate that I noted earlier from FactSet.

I particularly believe that IBM is a dark horse in the AI software race because of the huge surprise in FY24 free cash guidance it gave earlier when reporting its Q4 FY23 earnings. The company is making sizable progress in improving its working capital and thereby benefiting from higher employee productivity. In addition, I also expect its Software segment to pick up pace in the back half of FY24, while its consulting segment will continue to grow in line with the projections I had noted earlier from Gartner, as I believe that AI should prove to be a meaningful driver in the back half of FY24 for IBM’s Software segment.

Macroeconomic and Valuation Risks to look out for

At the moment, I believe there are two key risks that stand in the way of software stocks outperforming in the short term.

The first one is the inherent risk with the valuation multiples that have significantly expanded over the past couple of months, as the S&P 500 had been pricing in a “soft landing” scenario as inflation was declining up until recently, with the underlying expectation of a far higher number of rate cuts than the Fed had outlined in its projections. However, we are starting to see the sentiment change, as inflation is once again printing on the hotter side and interest rate futures are now pricing in just two rate cuts, compared to six at the beginning of the year. In my opinion, the longer the Fed keeps rates high, the higher the probabilities for the US economy to enter into a period of broader slowdown, as companies will cut back on spending, which will hurt the forward guidance of the software industry.

In fact, as per FactSet, I see that while the expected earnings and revenue growth projections for the S&P 500 are below the five-year averages, the forward price-to-earnings (PE) ratio for the S&P 500 is above the five-year average, signaling elevated levels of optimism and very little margin of error for most of the companies. Currently, the S&P 500 trades at 20.5x its forward earnings, which is 7% higher than the five-year average PE of 19.1 and 14% higher than the ten-year average of 17.7x.

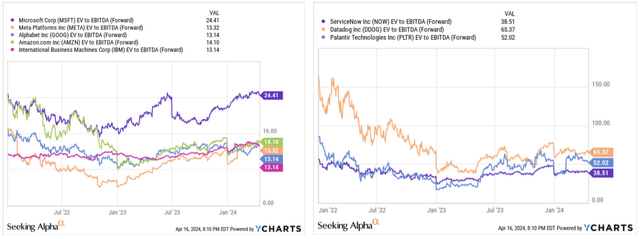

I have attached the EV/EBITDA forward multiple for all stocks below, which shows some of these companies, especially Microsoft is trading at elevated valuation multiple, relative to its historical standards.

Valuation multiples of software companies

Although current valuations are extended driven by investor optimism, I believe that the success of software companies Q1 earnings will be driven not only by whether they meet or exceed their revenue and earnings expectations, but also by how management sets the tone when it comes to its forward guidance on revenue and earnings growth estimates, driven by their AI product roadmaps in order to drive deeper adoption and spend per customer as businesses consolidate across vendors. One more thing that I would like to point out is that so far we have seen most of the spending in IT and software concentrated among the enterprise customers, whereas small and mid-size businesses have lagged behind, as they are still cautious given the current macroeconomic environment.

Conclusions

Despite the risks to the market from macroeconomic uncertainty and elevated valuation concerns, I believe that should the current market volatility induce a sizable pullback during Q1 earnings, which resets valuation multiples, it will offer an attractive entry point across select software companies depending on how they continue to deepen adoption of their solutions among customers as they build out their AI product roadmap while expanding profit margins.