PeopleImages

Main Thesis & Background

The purpose of this article is to take a macro-view of the markets at the current moment to try to find some ideas that have relative value compared to the S&P 500 (or NASDAQ 100). This is top-of-mind for me right now because the "Mag 7" are dominating market gains, delivering strong returns but also making US indices very concentrated and top heavy. While this has certainly been "good" news for holders of these indices and stocks, it begs the question on how much longer those gains can last. If the euphoria does not continue beyond January 2024, it will look silly in hindsight to not have diversified.

With this understanding, I want to put myself in a well-rounded position as we dive deeper in to the new year. My portfolio is very US-heavy, and this has led me to now be very overweight large-cap US names. While I will continue to ride this trend higher (hopefully) with my existing positions, my concern here is how to remain balanced as a whole. In this review I will touch on three areas I am adding to in Q1 to help me accomplish that balance.

Europe Looks Cheap, Despite Gains

One of the first places investors can look for value if they want to remain focused on developed markets is Europe. This is generally an area I was cautious on for a number of reasons. This included inflation, sluggish growth, and geo-political risks stemming from the Russia-Ukraine war. Yet, despite leaning against buying in to this theme, I have had to recognize my outlook wasn't vindicated. European equities have shrugged off those headwinds and delivered strong gains - especially in the short-term:

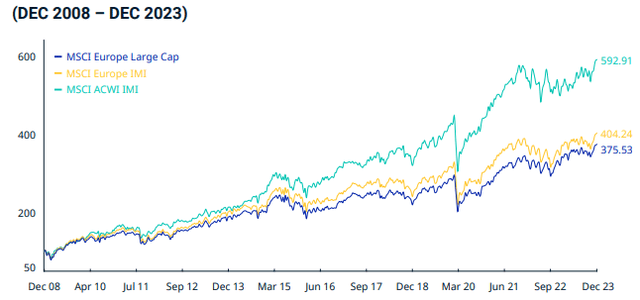

European Benchmark Performance (MSCI)

As you can see, European equities have certainly pushed higher over the long-term and rallied strongly off Covid-era lows. However, this performance lags the S&P 500 over time, to the point where the relative valuations have gotten very wide.

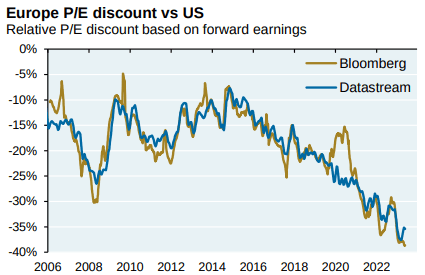

This brings me to a chief reason to consider "Europe" at the moment. Based on forward earnings estimates, Europe is remarkably cheap compared to the US (for large-cap holdings):

Relative P/E (Forward Earnings) (Bloomberg)

While being "cheaper" is not an automatic translation to gains, it does help to limit the downside potential in my view. Further, I see a couple reasons why this backdrop is favorable enough to warrant buying.

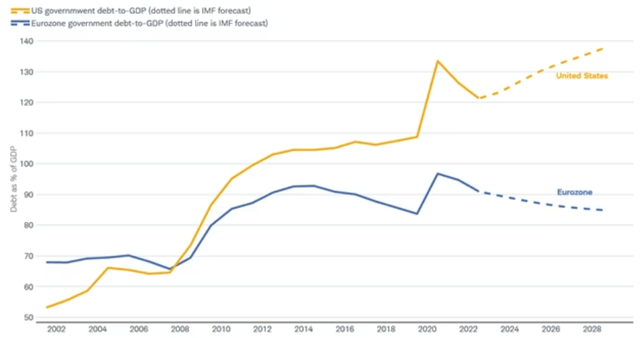

One, the EU-zone is not going to be facing the same debt dilemma as the US will. This is a story that seems to play out every year now - or multiple times a year to be more precise. The US has a major borrowing and spending problem, and deficits continue to balloon. By contrast, Europe is setting itself up to see its debt to GDP decline going forward:

Debt to GDP (%) (Charles Schwab)

What this tells me is that the Eurozone won't have to contend with this headwind at such a large degree as the US will. It gives the central bank and individual country governments more flexibility going forward. It also removes some of the cloud or headwind facing US budget talks in the months and years to come. This divergence is not great to see as an American citizen, but it does offer support as to why Europe is a decent spot to diversify.

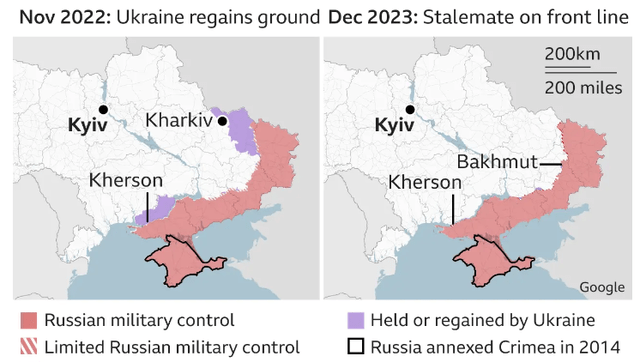

Two, the Russia-Ukraine war continues to be contained within Ukraine. I bring this up because at the onset of the war I halfway expected either an expansion of the conflict throughout eastern Europe and/or for that to force the hand of NATO - expanding the conflict into a wider affair and enhancing the geo-political risks. Fortunately, neither of these scenarios have occurred yet and the conflict remains relatively contained. This is not to say that there has not been a tremendous cost and loss of life - both have occurred and it is tragic. But the fear of a widening conflict has been avoided for now:

Regional Conflict Contained (BBC)

This is essential because it helps make central and northern Europe more investable in my view. If they can remain out of the conflict and solely focused on providing financial and moral support, then corporate earnings there are not as much at risk. I had a strong suspicion this military conflict was going to be in a much worse position today than it is, and that allows me to invest in European equities when I have shunned them for a while.

**I view large-cap European equities as a diverse group that can be played in a plethora of ways. Two large-cap funds for a more passive, conservative investor that I would recommend are the iShares Europe ETF (IEV) and the SPDR Euro Stoxx 50 ETF (FEZ).

Municipal Bonds Supported By Rainy Day Funds, Above-Average Yields

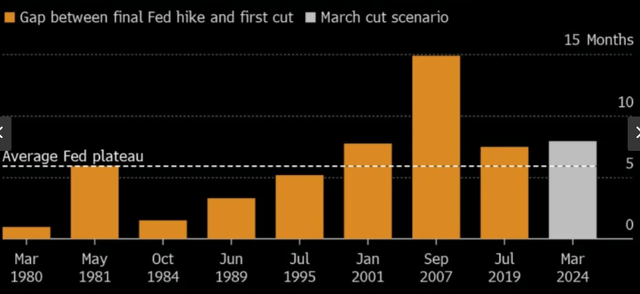

A second source of potential value at present is in the fixed-income corner of the market. This is an area that has rallied since Q4 (on average) on the backdrop of a Fed pause and potential for rate cuts in 2024. There is some merit to this argument. In past cycles, the Fed has generally begun cutting rates within 3-7 months after its final hike. When we hit March 2024, this will put the Fed past its average cycle range, meaning that a cut is likely to happen by mid-year in my opinion:

Gap Between Last Fed Hike And Subsequent Cut (Yahoo Finance)

This has spelled good news for bonds because investors have been rushing to get in ahead of these cuts. Since bond prices rise when rates fall, investors are trying to front-run this eventuality in order to lock-in higher yields today and potentially benefit from rising bond prices later this year.

The logic is pretty straightforward, and there are a number of different avenues one could take to capitalize on this development. One of my preferred methods is the municipal bond market - but I would note this is particularly driven for individuals in higher tax brackets. Due to their tax-exempt status, the tax adjusted yield is often quite attractive for those with a hefty burden. But for others - such as those with low incomes and/or retirees, they may not be as attractive. So keep your own individual circumstance in mind when you do your analysis.

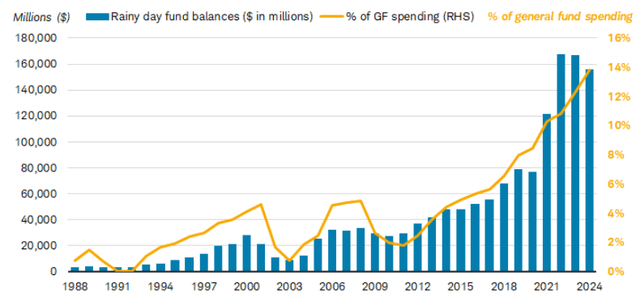

To understand why I believe munis are well supported, let us look at the condition of state finances - whose credit quality are backing the General Obligation (GO) muni bonds that make up this market. Due to spending restraints, resilient tax collections, and Covid-era federal stimulus, many states are actually sitting with large "rainy day" balances. While current headlines are suggesting budget problems on the way (think California), we should remember that, on average, states are entering 2024 on a firm financial footing:

Rainy Day Funds (Aggregate) (National Association of State Budget Officers)

This tells me that local and state governments are not at risk of major defaults in the year ahead as they can draw on these reserves to make good on their obligations. It also means they can tap the muni market for new issuances at reasonable yields since the rainy day funds offer some relative financial security. All of this bodes well for the underlying quality of these assets.

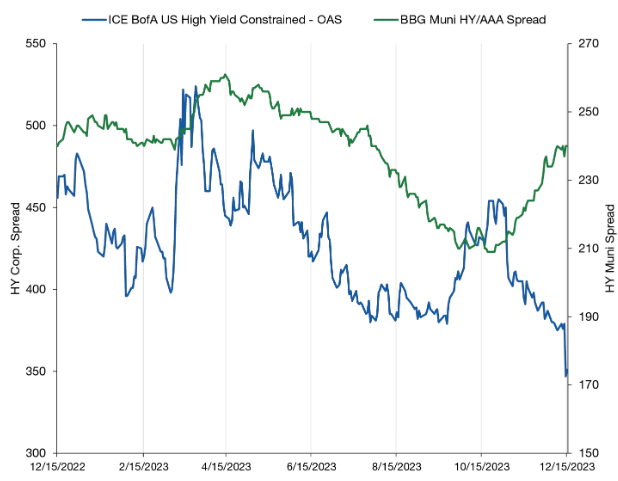

If we move down the ladder in terms of credit quality, there is also clear relative value in high yield munis. This offers investors a higher income stream - albeit with more risk - but this is a sector I don't mind pushing the envelope a bit given their historical performance. For perspective, let us note that while high yield corporates have seen extensive spread narrowing in the last stage of 2023, the same cannot be said for high yield munis:

Relative Spreads (High Yield Corporates and Munis) (Lord Abbett)

What I take away from this is that the risk-adjusted yield for junk-rated munis is favorable both in isolation and compared to high yield corporates. When I factor in the tax savings, it seems like a no-brainer to me.

**There are many ETFs and CEFs to play this space, as well as buying individual issues. I continue to be cautious on leveraged CEFs for the time being, given the inverted nature of the yield curve. But I like the VanEck High Yield Muni ETF (HYD) as a way to enhance my portfolio's yield.

Energy - For Value And A Volatility Hedge

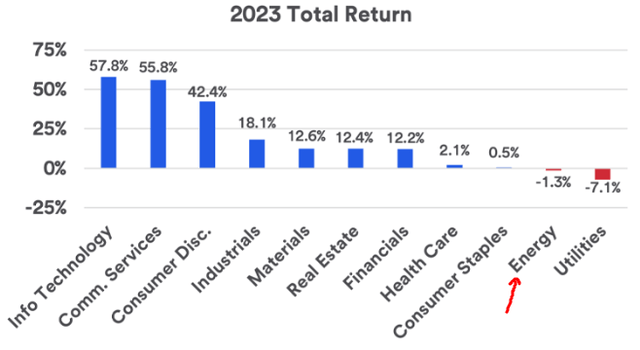

My third point of interest is the Energy sector - namely oil and gas. After a stellar year in 2022, this is a sector that lagged in 2023. In fact, it was one of only two sectors (the other being Utilities) that registered a calendar year loss:

2023 Calendar Year Returns (By Sector) (S&P Global)

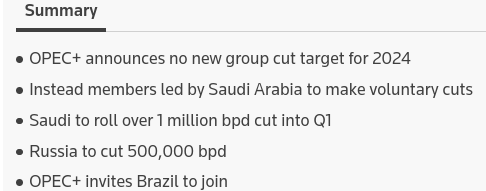

Looking ahead, I see multiple reasons why this can be viewed as an opportunity. One, while US oil production has been rising, OPEC+ has been trying to negate that reality through production cuts of its own. I view this stance as a long-term tailwind for oil prices and believe the market is currently discounting the price crude should be trading at. To understand why, here are some actions taken by OPEC+ in the fourth quarter of last year:

OPEC+ Policy Changes (Reuters)

My take on this is there will be continued support for crude prices coming from the collective bloc of a major energy player. If I am right, that means gains ahead for the Energy sector.

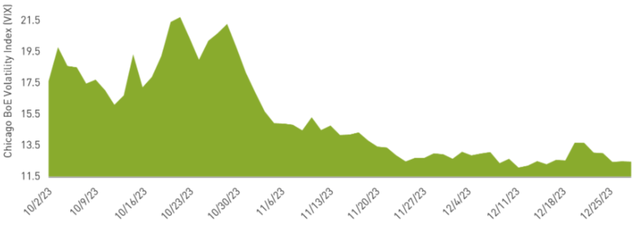

Compounding on this, I am of the belief the market as a whole is simply too complacent right now. When there isn't much to "worry about", markets tend to rise and hedges - such as commodities (i.e. crude oil), gold, and other metals - tend to lose some of their appeal. While volatility has been low for a while, that is precisely why I am concerned. It has been too low for too long, in my view:

Volatility Index (VIX) (USA) (FactSet)

This is relevant because when investors get worried it is usually because of some headline news. This could be interest rate related, due to poor corporate earnings, or geo-political risks. If the latter is the case, energy prices tend to spike because supply-chain disruptions - even when temporary - can cause big swings in commodity markets. If we look at crude oil prices now, we see that low volatility has resulted in oil trading in a narrow range - and near its annual low:

Crude Futures (WTI Crude) (Bloomberg)

The conclusion from me is that this is a good time to start building or adding to existing positions. The market is calm, oil prices are low (relatively), and investors are discounting future actions by OPEC+ in 2024 in my opinion. We should all know that oil prices are volatile and the Energy sector is too by extension. This means that timing is a bit more crucial than other, less cyclical sectors. And timing seems ripe to me here.

**I believe passive ETFs are a great way to invest in this space. I own the Vanguard Energy ETF (VDE) and the Invesco S&P 500 Equal Weight Energy ETF (RSPG) to balance out the top-heavy VDE.

Bottom-line

The new year has been a boon for equity investors and - perhaps more importantly - seems to be a continuation of the out-performance by the "Mag 7". As a net-long equity investor, I'm happy to enjoy the ride. But as someone who also needs to put fresh money to work every week, I see limited value in chasing more returns by the Mag 7 with this new cash. As a result, I used this review to dig in to three areas where I will be deploying fresh capital because I see relative value and plenty of potential upside. I hope my followers find this article useful, and I wish everyone a happy and healthy start to 2024.

Please consider the CEF/ETF Income Lab