It's about time. I have said in many past writings over the years that the U.S. is the global village idiot when it comes to energy policy. I'd like to reiterate that here. But there seems to be a change happening in Washington D.C. that is warming the heart of me, T. Boone Pickens, Jim Cramer, Harry Reid, and a whole new army of nat gas fans.

I have described the danger of trying to safely get to a post carbon world without a carbon bridge. The problem with solar, hydrogen, ethanol, and wind is that they take about as much fossil fuel to make these forms of energy as the energy it gives us. They do not displace much fossil fuel if any. There are exceptions, like sugar ethanol. However, until we have a good scientific handle on what is really worth a big infrastructure build, in net energy terms, we desperately need a good old fashioned high net energy bridge fuel -- like natural gas.

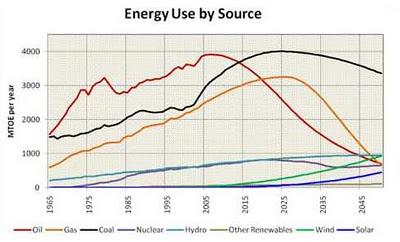

Even before the fracing revolution of the last 5 years, there was a span of about 25 years between the Hubbert calculated peak production of conventional crude oil and the corresponding peak for conventional natural gas. As we pass the oil peak, and I'm referring to oil from conventional pressurized reservoirs which takes relatively little energy to retrieve, the still climbing nat gas curve starts to form a criss-cross where we embark on the "bridge" to a stable energy supply for the next couple of decades. If you put all the forms of energy on a time-line, you see this bridge and its relation to the developing fuels of the future: (click on images to enlarge)

You basically have the huge separation by scale between the fossil fuels and the renewables. The fossil fuels