There has been a report from a Michigan news outlet that Mid-Michiganers are increasingly turning to

, as their use preserves wealth and does not lead to inflation.

The Liberty Dollar was perhaps the biggest US experiment in hard money, spanning some 13 states. The founder’s

office was raided and pending charges against have been filed. Most hard money advocates believe that the Liberty Dollar is not unlawful, and certainly not unconstitutional, but that the government and central bankers cannot allow successful alternate money to take hold in America. This would destroy their ability to tax the people stealthily through inflation.

And because JP Morgan thinks gold is only money, we do too.

- JP Morgan, testifying under oath to Congress before the Pujo Commission, 1913

Ok, so why do we believe the value of money relative to paper dollars will continue to increase? As noted in Parts 1-3, the price suppression schemes have held commodity money down in dollar terms. This means when you buy the physical form of it with paper dollars, you are getting a huge discount. We do not believe $1200 and $19 are the final stops for gold and silver, respectively.

Gold Price Targets

There are several ways to look at it. First, if you take M3, the broadest measure of money, and divide it by supposed US gold holdings, then you could say that gold in the US may roughly be valued at

$14,000,000,000,000 (M3) / 8000 (tons of gold) = $54,000 per ounce

Since all currencies (debt) are intertwined now, that is not the correct number. We would have to calculate the value of all currently issued paper currencies and divide it by all gold known to exist (most of historically mined quantities). Since we only need ballpark figures on this one, we’ll try alternative methods.

Previous Highs

What if we take the high in 1980 of $850 and adjust for CPI inflation? That gives us

a $2300 price target. But since we know

government numbers are gimmicked, Shadowstats inflation numbers estimate a target closer to

$6000 in dollar terms.

Another alternative is that we could measure gold against other commodities and see where we land.

Comparing Commodities

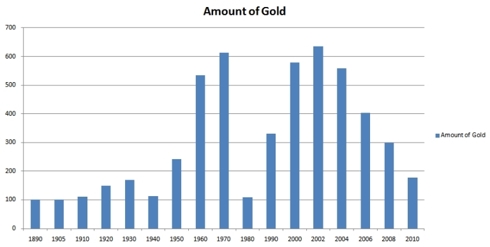

The first chart above shows how many ounces of gold it would take to purchase an average sized house. The historical average leading up through the turn of the century was 100 ounces. Since we are currently near 190 ounces of gold needed to purchase a house, it is clear that to reach historical equilibrium we need gold to rise and housing to fall in some combination so that 100 ounces of gold will once again purchase an average size home.

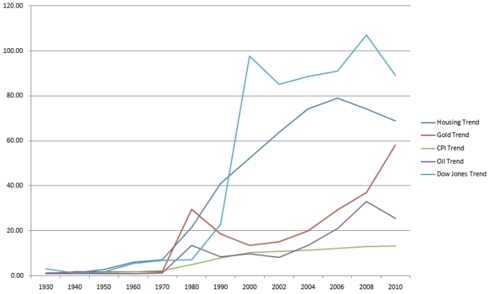

Next we chart housing, the DOW, and oil against gold. The chart compares relative value changes in each item to measure scale. (We removed paper money as an index because paper has no intrinsic value and therefore cannot be used to measure real wealth.)

You can note that commodities are severely undervalued compared to the two bubble assets of this decade, stocks and real estate. Even with two recessions and bubble pops, the prices of housing and stocks are still overvalued relative to commodities. Also note in the chart above that while oil, housing, and stocks have reacted negatively to the bad economy, gold continues to march straight up.

This is the main reason we feel gold has a long way to go before the price reaches equilibrium. As I noted in article

Is the Housing Market in Recovery (thanks Reggie), the already begun Alt-A crisis will cause real estate to devalue further and we cannot make up for it with regulatory ‘patches’. The markets always win in the end.

Based upon the charts above, it would not surprise me to see gold rise

at least an additional 25% of current price before gold and housing reach equilibrium. Target =

$1500.

And based upon my studies of asset cycle investing, housing will move through equilibrium to some bottom level, while gold will shoot through equilibrium and go into some level of bubble value. Along the way, the failure of paper currencies will cause people to panic and go back to monetary metals, which will cause a temporary excess rise in the value of gold relative to all else. Henry Hazlitt in his book,

The Inflation Crisis and How to Resolve It, noted such behavior in Germany.

Deflation Value

Lastly, we look at what in a gold standard (not gold exchange standard) should be increasing purchasing power due to technology improvements. As noted in my book,

The Drop Shadow, deflation caused an increase in the standard of living, despite periodic wars, until the point at which the Fed brought paper money to stay. The rate of deflation, or increases in purchasing power,

amounted to roughly 34% increase in the standard of living from 1800 to 1913, with the largest gains coming between 1820 – 1860 and 1870 – 1913. If not for the Civil War, the nation’s prosperity would have exploded even more. Source:

Minneapolis Federal Reserve.

This allegation is just the opposite of the truth. The heyday of the gold standard was the 100-year period between 1815 (the end of the Napoleonic wars) and 1914 (the start of World War I). This was the age of transcontinental railways, intercontinental shipping This was the time when all the key inventions were made that ushered in the age of electricity and electronics, the age of the internal combustion engine, the age of aviation, the age of wireless telecommunication, the age of the X-ray, radium, and the ultrasound, etc. Financing these discoveries and their applications in production, transportation,telecommunication, and therapeutics wouldn’t have been possible without the gold standard and the accumulation of capital that it facilitated.

So if we take 34% noted above, and apply it to the value of goods gold can buy, we would see a dollar ‘price increase’ of gold 34% before the bubble in gold begins. That is assuming the pace of technological advance is the same today, which I believe it is much faster than the 1800s and that 34% number may be substantially higher because of that. That would give us a very conservative price of target of $1600 per ounce.

Conclusions

So set your gold target very conservatively to $1500-$1600, to $2300 in government-reported inflation terms, and most likely to $6000 in event of a paper currency crisis (real world inflation terms), before the bubble phase of gold begins.

At that point, the bubble cycle of gold will begin as the paper currency crisis takes hold. Gold will continue to march upward to some atmospheric value before peaking; whereby it will come back towards equilibrium.

Tomorrow, in Part 5 of the series, we look at Silver.